Acronyms and glossary

I realize that I don't define all the words that I use when writing. And, in the realm of blockchain, cryptocurrency, technology even, it's easy to fall into the trap of using buzzwords. The fancy words might obscure a lack of understanding. And they might discourage friends from diving in and learning more about this fascinating space.

Quick challenge then: to explain in simple words a few prominent terms. Fun exercise because if I simplify to the point of inaccuracy, I will lose my technical readers. And if don't simplify enough, I fail at transferring this passion to my friends.

Crypto: "Crypto" is the new "cyber". A term that encompasses a whole culture, and yet, has been diluted to quasi-nonsense. Crypto is short for cryptocurrency. (When I say "crypto", though, both cryptocurrency and cryptography come to mind because...) Cryptocurrency is a currency that is made possible by cryptography, as opposed to a currency that is issued and controlled by a central authority, such as the central bank in Europe or the federal reserve in the US. And cryptography is the practice and science of secrets. Modern cryptography uses lots of mathematics, including one-way functions. One example of a type of one-way function that is heavily used in cryptography is called hashing.

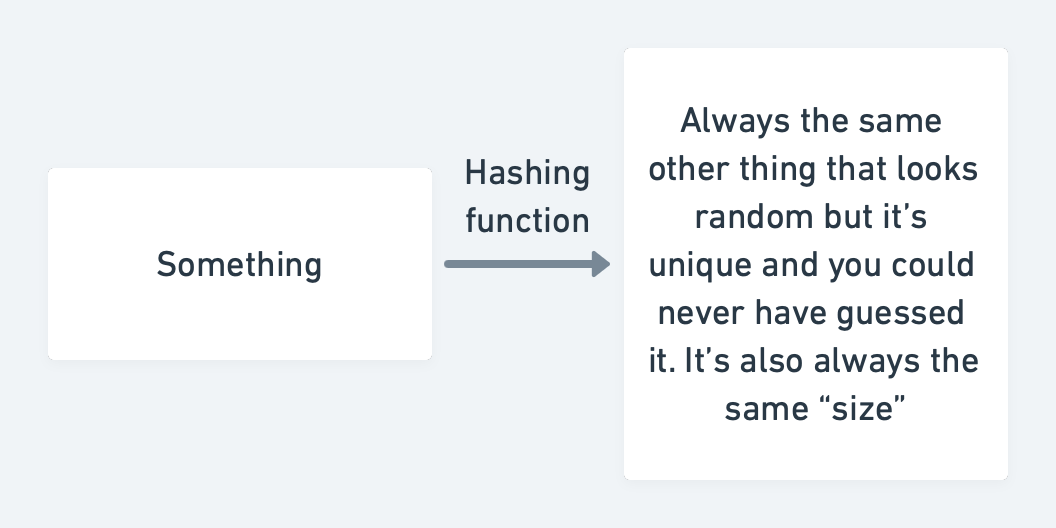

Hash: a mathematical formula that results in a non-guessable, unique output for any input you give it. Really powerful stuff for which I can't seem to find a good analogy. So let's unpack it

That's not the whole picture. Let me be more specific.

One of the most commonly-used hashing functions is called sha256. If you apply sha256 to the following string of characters "I wonder what the hash is for this sentence", you get the following result. c7e8de947e59868f86665e828fac896213d9059f074e7ad88f6c4b5f3fd381c6

Anyone in the universe can apply sha256 to my little sentence and the result will always be this c7e8...81c6 string.

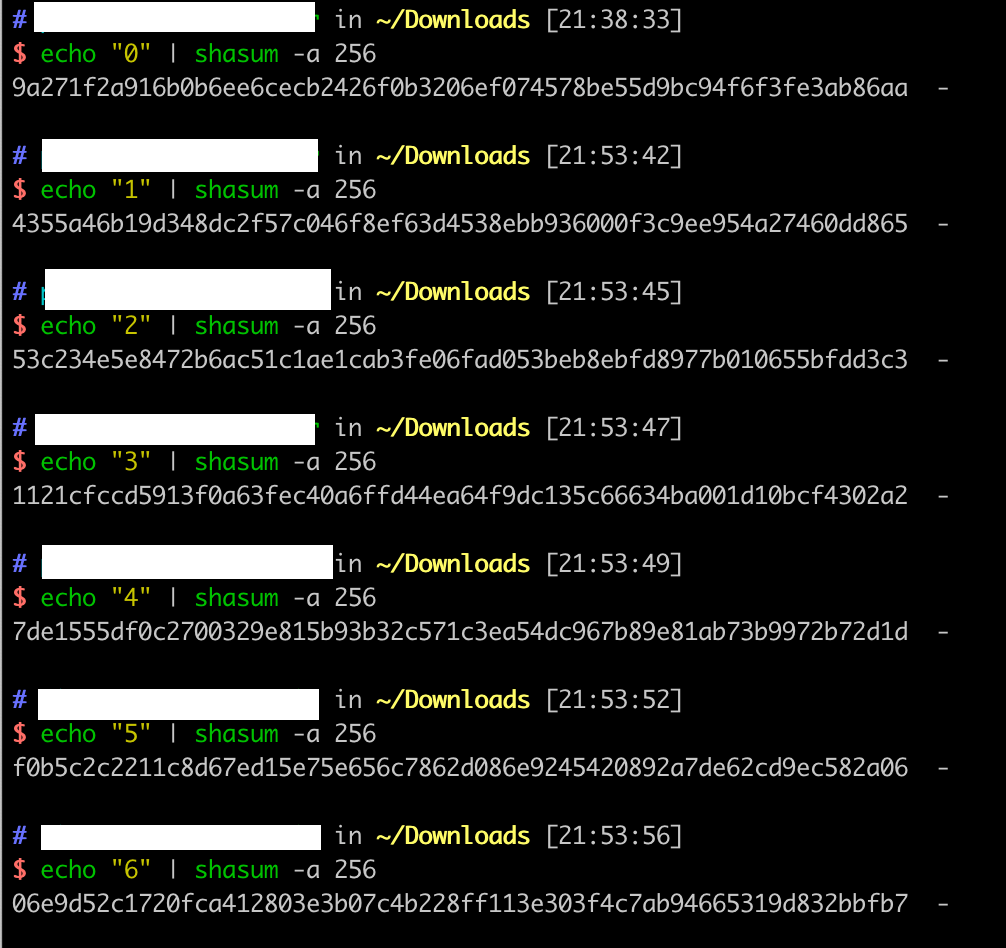

To give you an idea of the randomness of the output, I am simply going to add a period at the end of this sentence. See how the hash differs:

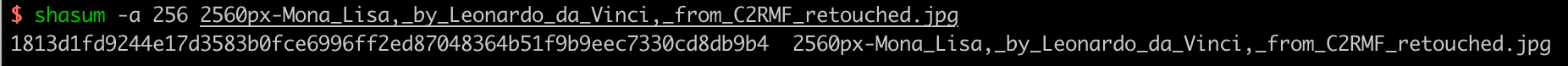

I can apply sha256 to anything I want as long as the input can be represented as a string of character. A file is nothing but a big string of characters. A picture on a computer is a file.

On Wikipedia, there is a picture of the Mona Lisa. I can hash this picture.

Hashing is powerful for many reasons. One of them is that you can make it a game to find results that satisfy constraints. One such puzzle could be: can you find a string of characters for which, when sha256 gets applied, it returns a hash that starts with a zero? This might take a few tries.

What about a hash that starts with 10 zeroes? You can't guess the output of a hashing function so, you'll have to try different inputs until you get the result you desire. The harder the constraints, the longer you'd have to try. This might sound like a pointless exercise but it is a large part of bitcoin mining: running tons and tons of hashing functions, competing to solve an arbitrary puzzle. Once you've solved the puzzle, you can claim "hey, I found this hash that satisfies all the constraints we agreed upon. I did the work. There was no other way for me to find this result than by doing the work."

(why Bitcoin miners solve an arbitrary puzzle is something we can get into in another article if you're interested)

Another reason hashing is powerful: since it is (currently) impossible to guess the input that ended up resulting in a certain hash, it means that one needed to have the input in order to apply the function to it and obtain a specific hash. You couldn't obtain that hash without having the input unless you simply copied the hash. Combined with a distributed, incorruptible ledger, this unlocks proof of existence.

Token: I got this one wrong until I looked it up for the purpose of this article 😳

A token is created on a blockchain while a coin is native to a blockchain. Both represent units of ownership. So, BTC and ETH are coins that represent ownership in the blockchain currency. But REP (Augur) or MKR (MakerDAO) are tokens that live on the Ethereum blockchain.

Some coins and some tokens are fungible, that is, they can be exchanged one for the other at an identical value. Just like a $1 bill can be traded for any other $1 bill, one bitcoin is fungible for any other bitcoin. Same for ETH. Fungible assets can be subdivided so you can own a tenth of a bitcoin. Or 0.003523 ETH, for example.

Some tokens are not fungible, however. It means that one token and another that are part of the same series, the same issuance, are distinct from each other.

If you're confused about fungible, non-fungible, think of it this way: does it merge? Dollars merge. If you have $10 and I give you $15, you now have a merged $25 balance. You go buy a $3 espresso, you now have a $22 balance. You were able to break down a single balance into two. But you cannot really merge, say, diamonds. Or trading cards. Collectible stamps. Even if some are worth the same amount.

DAO: this one, I've attempted at explaining before: it is the next evolution in human organization, management, and governance. There was the tribe, the city, the kingdom, the nation-state, the corporation. Now there are DAOs. Decentralized Autonomous Organizations. Decentralized refers to the absence of a central authority, which is often perceived, in crypto, as a weakness, a potential locus of corruption. Most DAOs I've seen bring together token holders, meaning, you are part of the DAO if you own the DAO token. There can be levels of ownership: owning some amount of tokens can give you voting rights and allow you to decide on the governance of the organization. Anyone who has access to buy DAO tokens becomes part of the DAO. Not just anyone, anything. You can imagine a DAO owning tokens of other DAOs. Since wallets can be created and assigned to applications or services, applications or services can take part in DAOs. DAOs are also powered by smart contracts, programs that run on the blockchain. Hence DAOs can be perpetually running, operating, with or without human oversight. They are autonomous.

Minting: the issuance of a token or a coin. To bring into existence a token, whether it is fungible or not. Since a token is represented as code, it can virtually contain any information you'd like it to contain. More on this later.

NFT: Non-fungible token. See token. But what's the relationship between a non-fungible token and a ludicrously expensive wallpaper or profile picture?

When creating a non-fungible token, you can encode its properties in the token. You could, in theory, save the image as data within the token information. But a hash (yes, remember, it's all coming together) of that image is sufficient because no other image would end up producing the same hash. The token contains the hash of the image. The token represents the image. Owning the token is like owning the image.

Anyone can copy a jpeg. But there can be only one owner of the token that represents this jpeg.

Actually, ownership of an NFT can now be fractionalized so many owners can partially own the same NFT.

If the art you are trying to represent as NFT is generative, i.e. it comes to reality procedurally, by running a program, you can capture the characteristics of a unique art piece in the token data.

You might also see "ERC-721" in reference to NFT. That's because when people imagined it would be cool to have not just fungible but also non-fungible tokens on the Ethereum blockchain, they put it in the form of a Request for Comment. It is a more formal and coordinated way of saying "hey, look at this doc, it describes a great idea we had, what do you think?". There are many Ethereum Requests for Comments. ERC-20 is about issuing fungible tokens. ERC-721 is an open standard that describes how to build non-fungible or unique tokens on the Ethereum blockchain.

Fun fact: even though CryptoPunks are considered one of the earliest NFT projects, they are not ERC-721-compliant. They predate ERC-721 and initiated the need for such a standard.

I'm stopping here for today. What are other words you see used and overused you'd like me to unpack simply and with a non-zero chance of inaccuracy? Let me know: newsletter@diffuse.club.