It's never too late

Recently, I have talked to friends who won't buy bitcoin because they believe they have missed the boat. Or they recognize it is a good tech, no doubt, but they'll jump on the next good one, the better tech, when it's there. Others think the price is just too high, for the moment. To all these people, I would like to present a few fundamental ideas:

- Bitcoin remains the safest, most battle-tested blockchain.

- Bitcoin is still programmable money. It is software applied to money. If money itself was one of the ten most important technologies humans invented, then it stands to reason that the union of software and money makes it another critical step in human development.

- Bitcoin is getting better. Bitcoin is getting faster and cheaper to use, via Lightning Network. Look at American corporations adopting Bitcoin in El Salvador. Look at Twitter on Strike. Improvements to Bitcoin have been and are being delivered.

- It is still unstoppable, as the repeated Chinese Communist Party bans prove.

- Yes, Bitcoin might only be Money v.0.1. I am convinced there will be better versions in the future. But don't miss v.0.1 just because v.0.2 might overtake it. Would you skip the current version of an app just because the next one is just around the corner? Would you pass on an investment because there might be others in the future? Besides, radio is still around. Stamps are still around. Are technology waves accelerating? Maybe. What would prepare you better for the next wave: to be taking part in the current wave or to have opted out entirely?

- Bitcoin is also a network. Network effect is full of inertia. The price of bitcoin moves fast. Payment infrastructure, less so. Now is network onboarding time and it will take a while before all interested have joined.

- Bitcoin supply is decreasing. The reward for mining blocks is constantly, inexorably reducing. This reward is the supply. And it is halving, roughly, every 4 years.

- Demand is far from done catching up. Few institutional investors have realized the performance of and incorporated the asset within their portfolio. A tiny minority of corporations have learned to include BTC as part of their reserve. A smaller subset, yet, of countries have made the move.

Bitcoin is not a train that you missed. It's a moving sidewalk. You can opt to step on it, even partially, and see where it takes you. You'll be able to quickly find out if it takes you backward or forward.

(And if bitcoin is a moving sidewalk, you might be tempted to think that a regular USD savings account is like a standard sidewalk. It's not. Inflation makes it a moving sidewalk that heads backward)

So, how do you do it? How do you safely get in bitcoin at low stakes? You DCA, of course. You use dollar cost-average purchases.

(I am not a financial advisor. Don't put in crypto more than you're willing to lose entirely. Do your own research)

You could sign up for a crypto exchange and buy a chunk of bitcoin. But when to buy? Should you buy immediately? Wait for a dip? How big of a dip should you wait for? <– this is called timing the market. There are people who dedicate their professional life to this. I'd rather do something else. A better way to get into bitcoin is to buy a little bit, often.

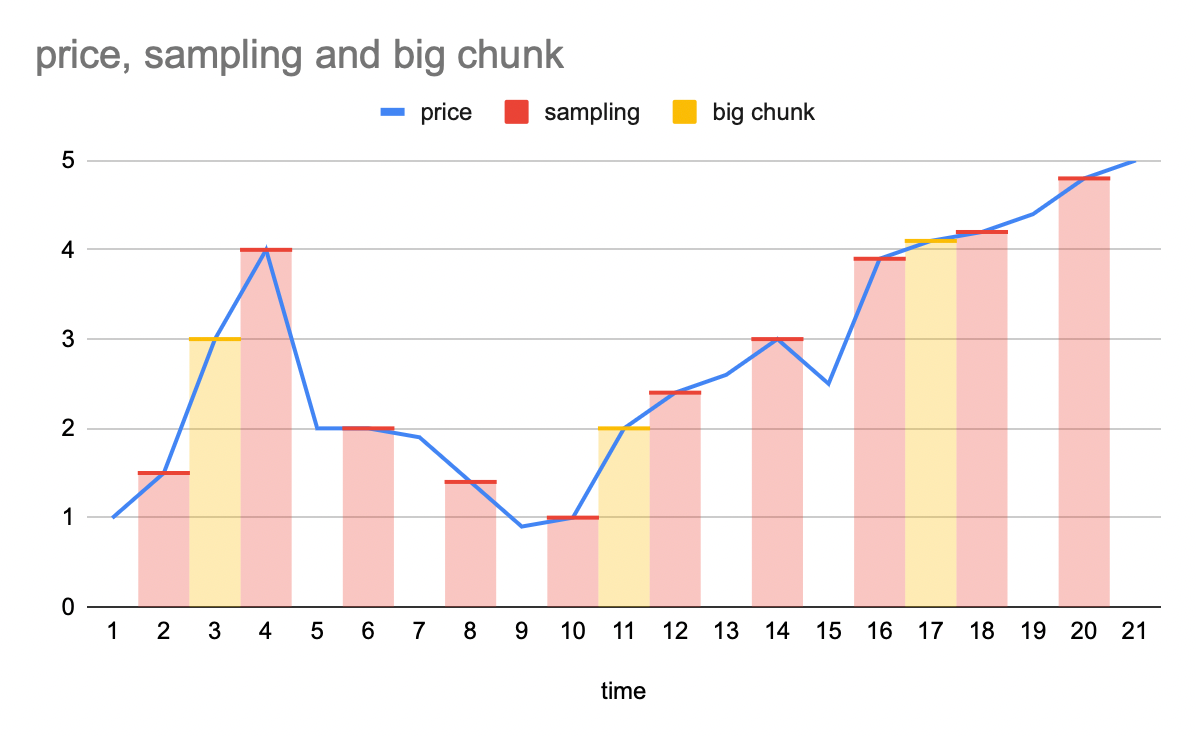

If it's high, you buy high, if it's low, you buy low. This is the same way 401(k) and 403(b) retirement investing schemes work. It is akin to sampling. The more you sample, the higher the definition. The higher the definition, the closer you stick to the price curve. The better you map to the market price for your purchase. Buying in larger chunks (yellow bars) means you have fewer chances of capturing the market price. Unless you're a champion at timing the markets, I recommend you dollar-cost average. You can DCA as little as $10 a month. My preference is for little amounts but more often.

Now, just because you're automatically buying at a set frequency, doesn't mean you can't buy a chunk here and there when the price is good. That's the cherry on top. Both methods aren't mutually exclusive. DCA is more set-and-forget. It feels like a savings account, with better returns.

There are many platforms offering to DCA into bitcoin nowadays. I use Swan Bitcoin. The user experience is a no-brainer. I can refer you so we both get a little extra but you don't need me to start using it.