Let your money make more money

In the US, you can make 1% on your savings. Or you can make 8%. Here is how.

- Sign up for a Gemini account if you don't have one yet. They will ask you for really private information like your Social Security Number and your address. They'll need this to report to the IRS and make tax forms for you at the end of the year.

- Fund the account by sending money from your bank account

- Buy GUSD

- Click Earn

How does a savings account work? Traditionally, one would place money in their savings account and expect a return, usually a few percent over a year. How is the bank able to make your $100 into $101 after 12 months? They take your money and they lend it. The same institution you are depositing your funds at is the one that is going to extend loans and mortgages to other people. But the interest rate on these loans is higher. One bank might allow you to borrow at 5% and let you save at 1%. They make the difference.

Let's take a quick detour to discuss risk.

"How come I can simply withdraw all my money in an instant if some or all of it is borrowed by other people?" Well, it's not just you placing money in a savings account. There are lots of people saving money and lots of people borrowing. This allows for a certain slack and inertia. Banks are regulated and they need to have a certain amount on reserve but, as a consequence of the COVID-19 pandemic, the requirements fell to 0%. There is no limit on how much of your account balance your bank can lend out. And, by nature, banks are incentivized to lend as much of your money as possible. Another way that banks are able to return your money when you want it is by borrowing from other banks. They can also borrow from the Federal Reserve when it's needed.

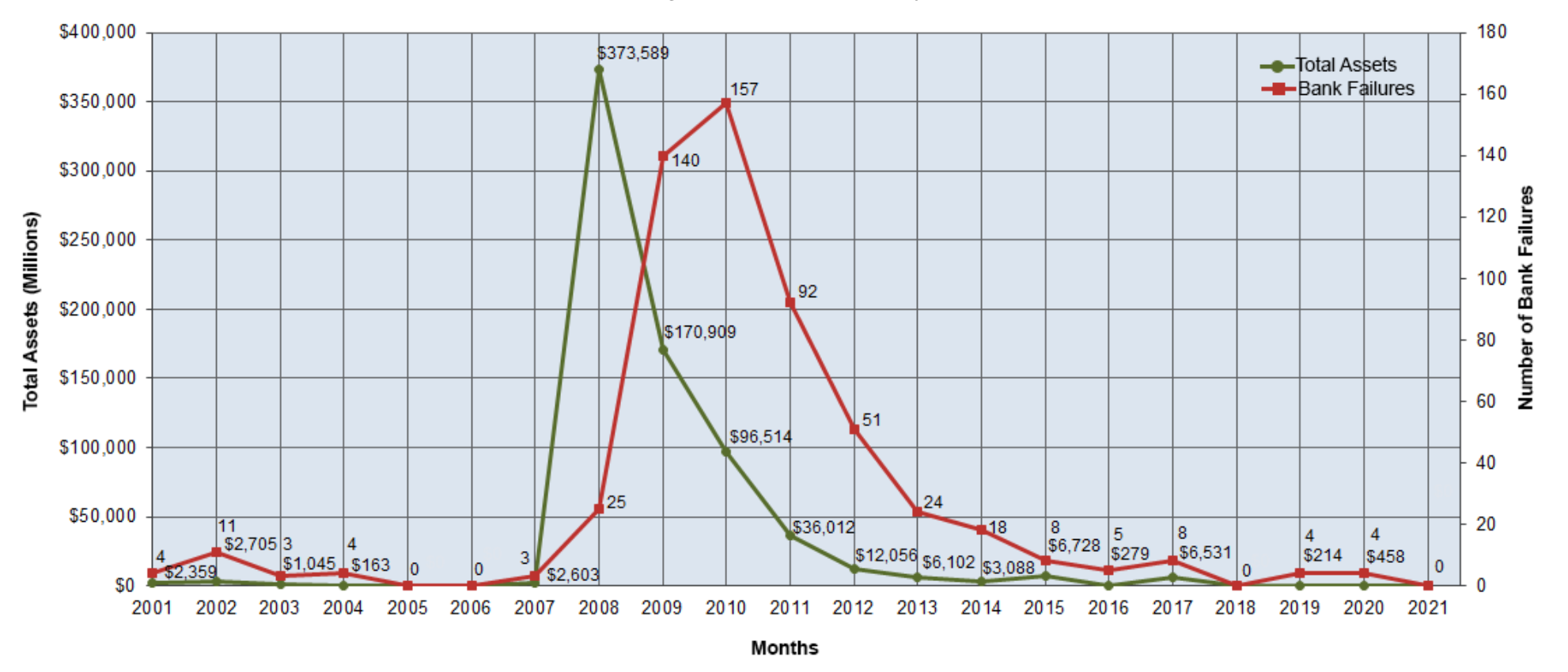

Bottom line: in order for your money to make money, it needs to be put in motion. And as it is being used, risk increases. There is always a chance that those who have received a loan do not return it. A lot of bank accounts are covered by the FDIC. The Federal Deposit Insurance Corporation. Their mandate is to provide stability to this system. Since October 1, 2000, 563 banks have failed and the FDIC was there to soften the blow. You might only be getting 1% interest but if your bank fails, you will probably get your money back. Unless all banks fail at the same time. We don't know what would happen then. It is possible we would know if banks hadn't been bailed out as a consequence of the 2008 subprime crisis.

So, that's your 1% return. How about the 8% return?

The 8% return you'd get on Gemini works similarly. With your dollar, you buy another dollar and you lend it. You send your USD to Gemini. You then transfer it to GUSD one for one. And then you lend that GUSD.

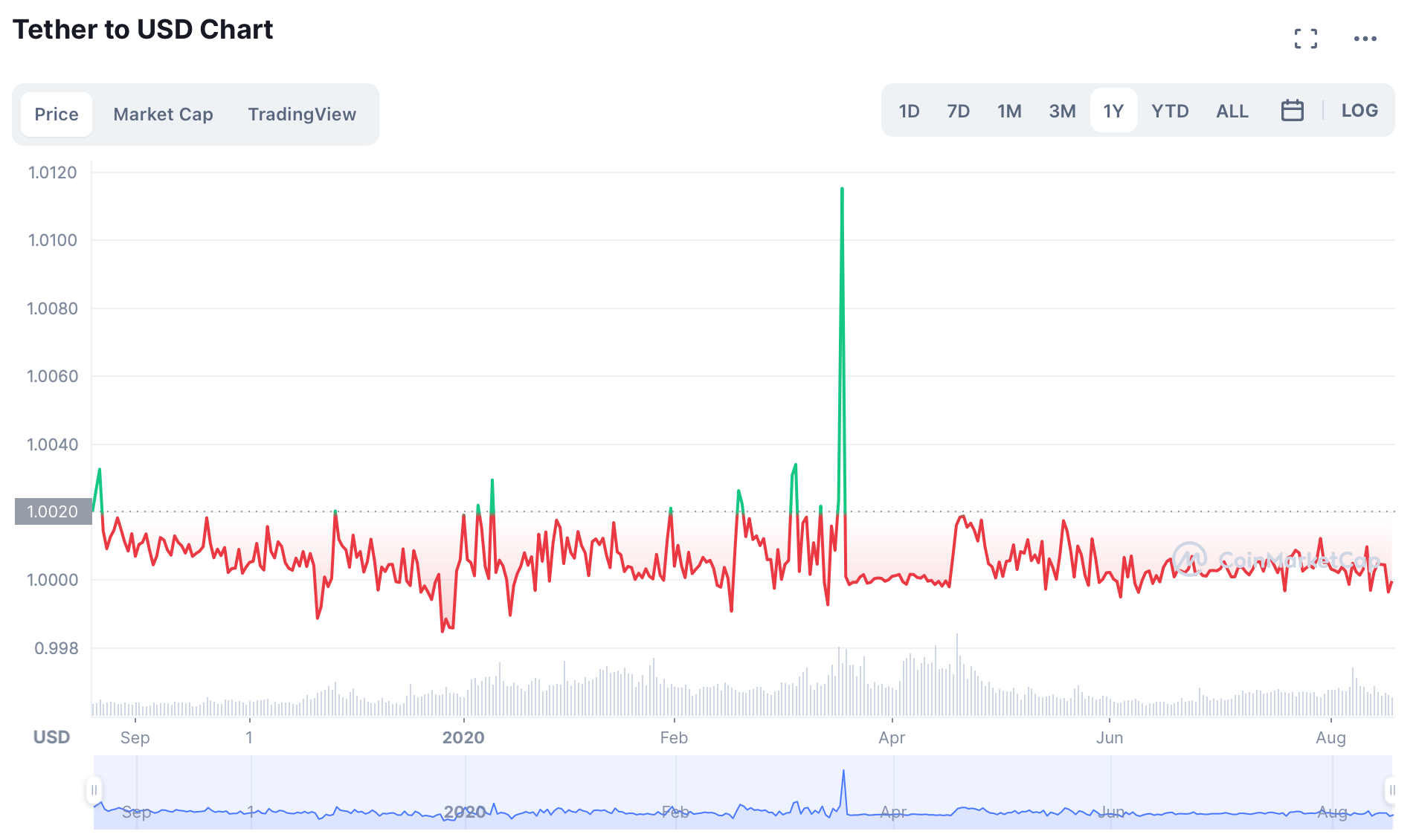

GUSD is a stablecoin. It is a blockchain-borne representation of the United States Dollar. It has the same face value. 1 USD == 1 GUSD. But it does not have the same properties. And that's what fetches a higher interest rate. The technology-accelerated finance world is really hungry for the blockchain-borne dollars you can let them use. The companies that operate in that space strongly desire a currency that is very stable but also has technologically-enabled properties that appeared since Bitcoin.

We should agree on what "stable" means for a currency before going further. I will use currency stability as the ability to have predictable value over time. Not the ability to hold the same value over time. But to have some value that you can foresee and count on. For example, and for the last few years, the consensus has been that the USD would lose 2% of its value every year. This has been predictable.

Now, the USD is very stable.

:)

Not absolutely stable. Not at all, given how much of it has been printed in the last few years, and as highlighted by the taboo of inflation. But, relative to other fiat currencies, the USD is really stable. A lot of people trust the USD to have a predictable value in the future, as compared to any other currency.

And so, as FinTech and Decentralized Finance firms go about their business lending and borrowing and making all kinds of more or less sophisticated money montages, they want to use the American dollar as their baseline. Their main asset. Their source of liquidity. This is what they count their money in. Not in bitcoin. They are not so excited about using the Euro. Or the Swiss Franc. The most appetite, right now, from the fancy tech-blockchain-finance economy is in using the American dollar as represented on a blockchain. Any blockchain really. That's why there are so many USD-denominated stablecoins. You can hear the DeFi crowd say "just give me USD on a blockchain, any blockchain".

We've established why the dollar is in demand. But this does not explain the full story. Why is the dollar-on-the-blockchain so appealing? What are the amazing properties that the dollar-on-the-blockchain afford?

- It moves faster than its fiat equivalent. Domestic bank wires complete in 3 days. Asset transfers on Ethereum, for example, happen in seconds and are generally considered final within minutes.

- It moves in a more verifiable and transparent manner. Anyone can audit the ledger and have great confidence that what was expected actually happened.

- it is programmable. You can write blockchain programs, also called "smart contracts", that hold it, move it, interact with it. A very basic example of this is that you can lock programmable money for a certain time. Or you can lock money until certain conditions are met. It becomes smart money. This might be the most important property.

These properties are so desirable, that people are acquiring a lot of blockchain-borne dollars. In fact, the desire is so big that people will buy USD stablecoins for more than a dollar.

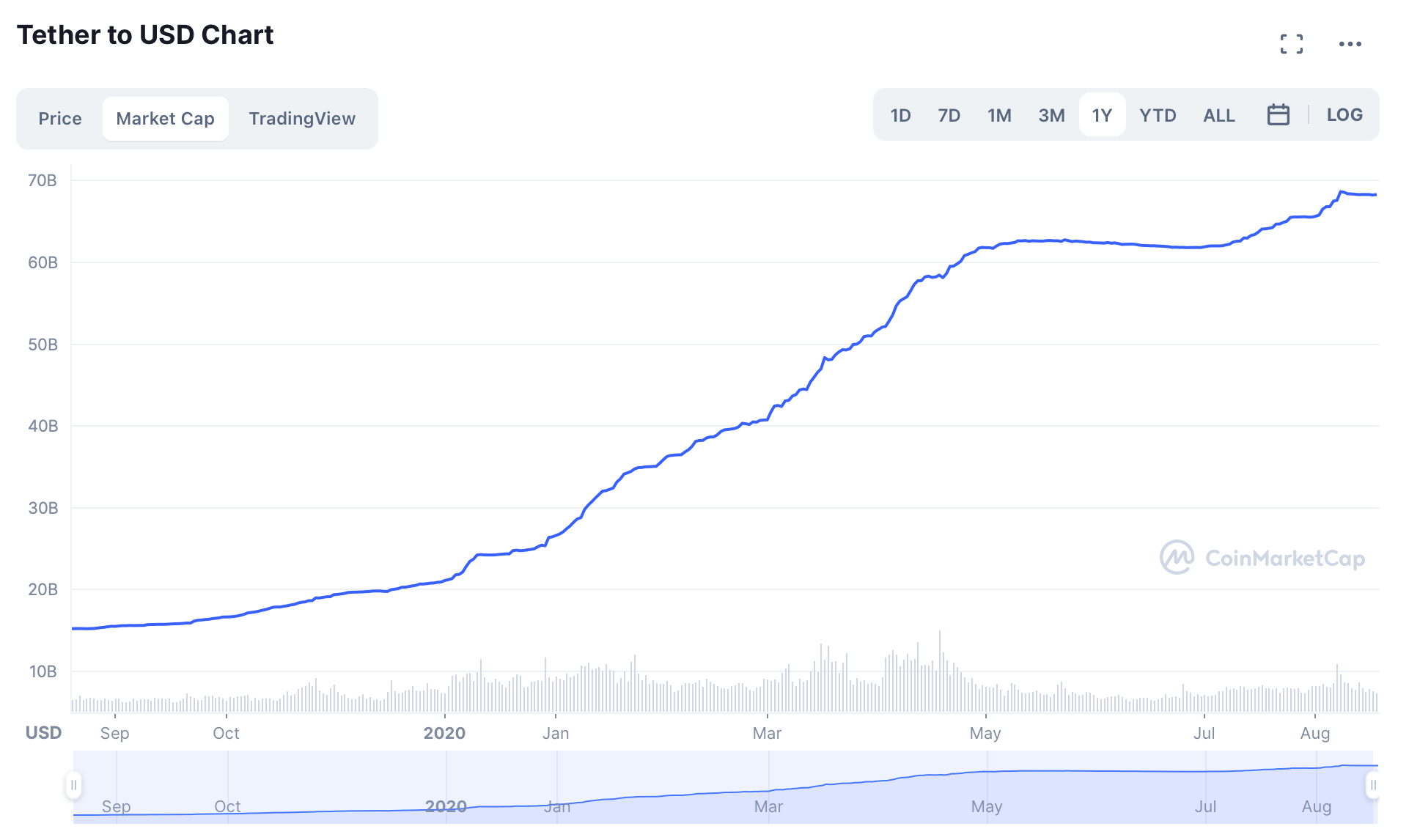

Not only that, but people will buy, for more than a dollar, a stablecoin that has been exposed to be scammy at best. And they'll do so to the tune of $68 Billion.

Let's get back to our 8%.

At this point, you should grasp why people want to borrow your crypto-dollar.

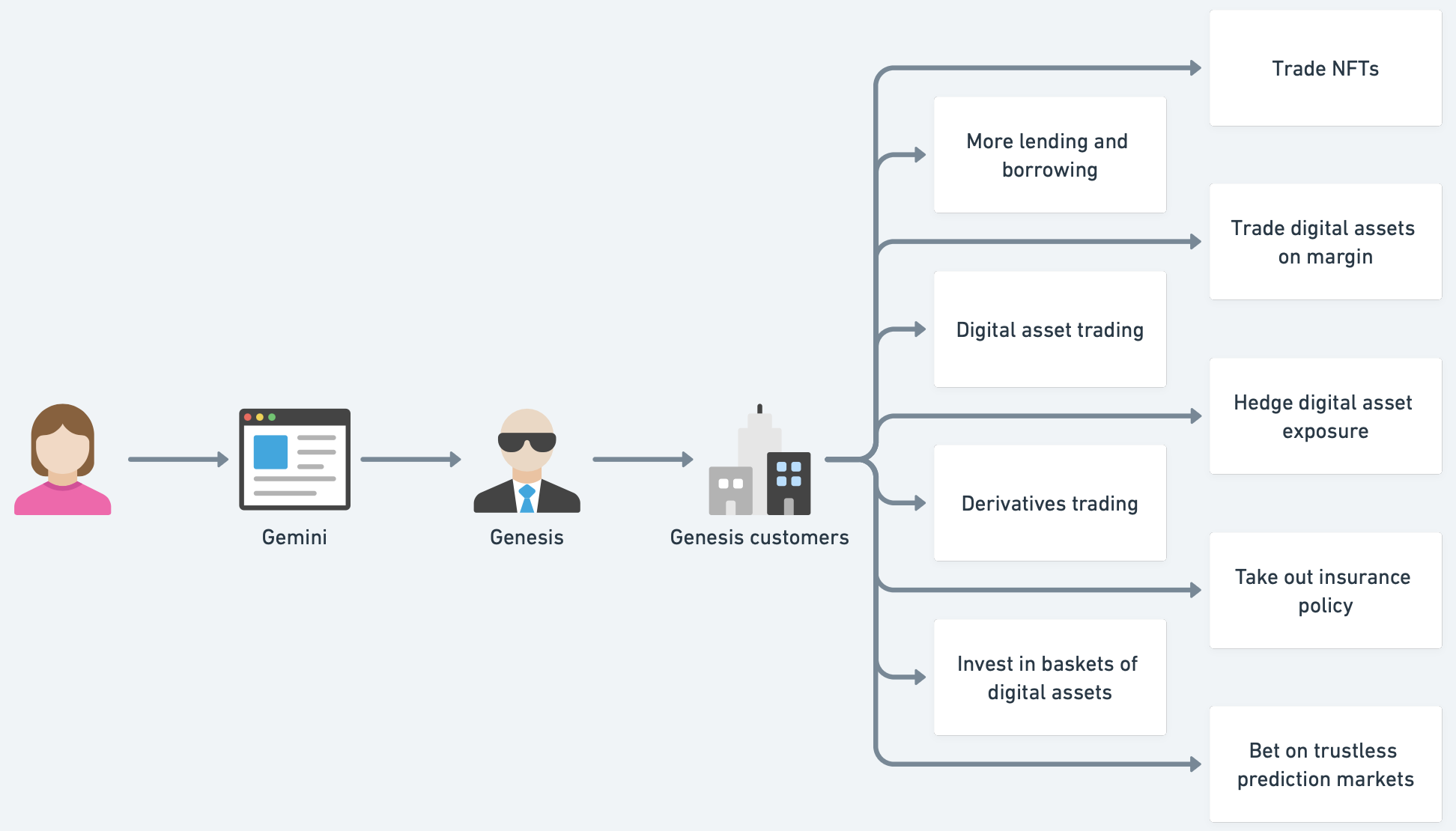

What they do with it is not something I am an expert on. I am very much interested in it and I can make some suppositions. It starts with Gemini lending the amount to Genesis. And then...

It is very important to understand as much as possible of a system when participating in it. I'll admit, however, that I do not have a full picture of what banks do with my savings account balance. Despite having somewhat steeped in that world for years. And similarly, I am not sure what Genesis' clients do with the crypto-dollar that Gemini let it borrow.

In the grand scheme of things, however, 8% is what you'll get if you loan your crypto-dollar. Whatever the borrower does with your money is 8 times riskier than what a traditional bank is doing with the money in your savings account. You get 8 times the reward.

Risk-reward ratio. 1% with the old model. 8% with the new.

Note that there are limits on transferring money to and from a Gemini account. GUSD is FDIC insured but not the Earn product, i.e if you simply hold GUSD, you're insured. If you lend it, you're not.

I debated whether to use a Gemini referral link for this article. I eventually decided against it. Writing this was a reward in itself and I hope that I helped you. If you want my referral code, just ask and I'll be happy to oblige.

If this was helpful to you, consider sharing it with a friend. That would be the ultimate reward.