Bitcoin Futures ETF is great 👍🏼 Don't buy it 🛑

You will soon be able to buy bitcoin like you would buy shares of Amazon

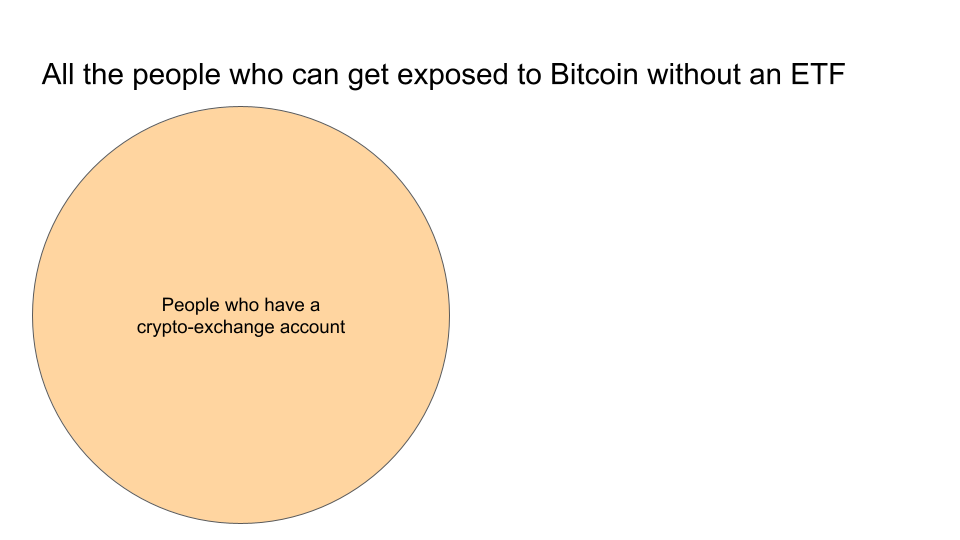

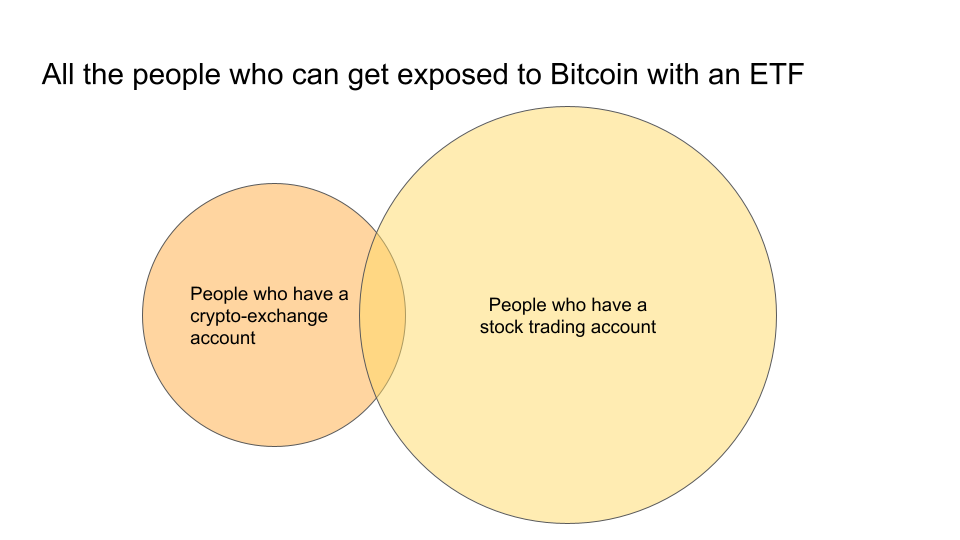

Why is this great? Because it increases Bitcoin's accessibility. More people will be able to get into bitcoin using the brokerage account they are used to. It moves like Bitcoin but it handles like a stock.

So, should you buy the upcoming Bitcoin futures ETF that trades like a stock? No. You should buy Bitcoin, not an approximation thereof. Here is why.

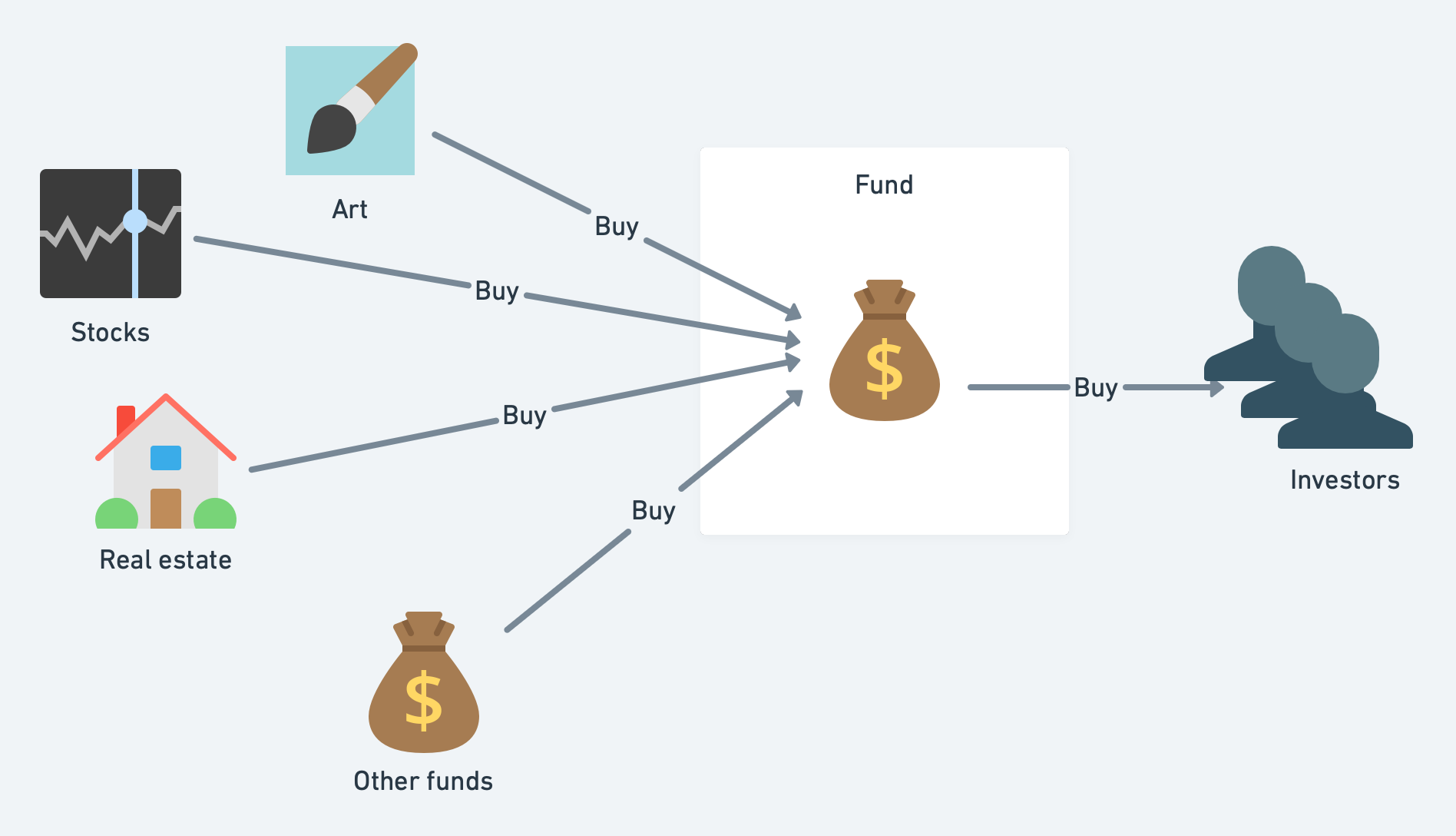

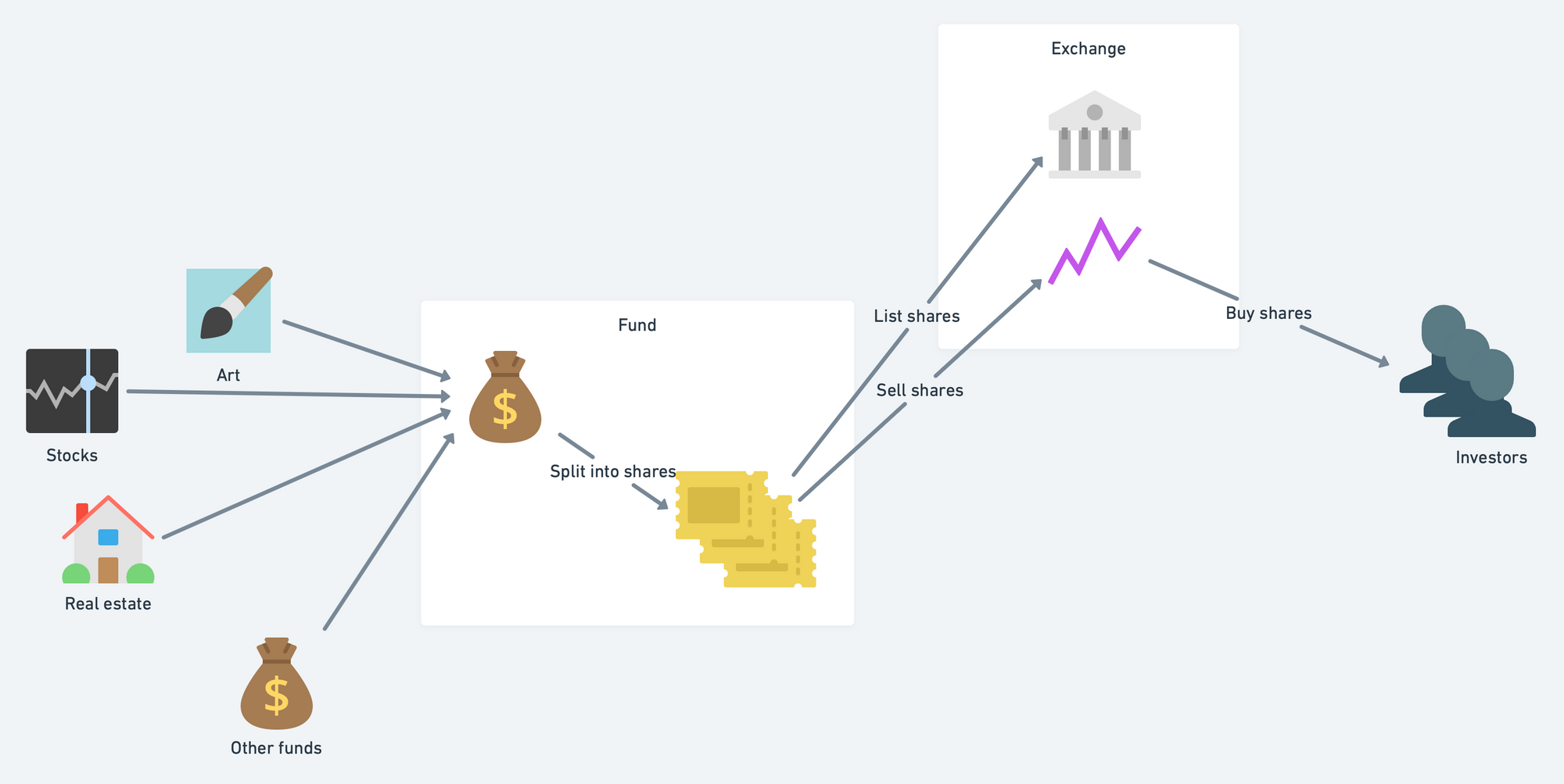

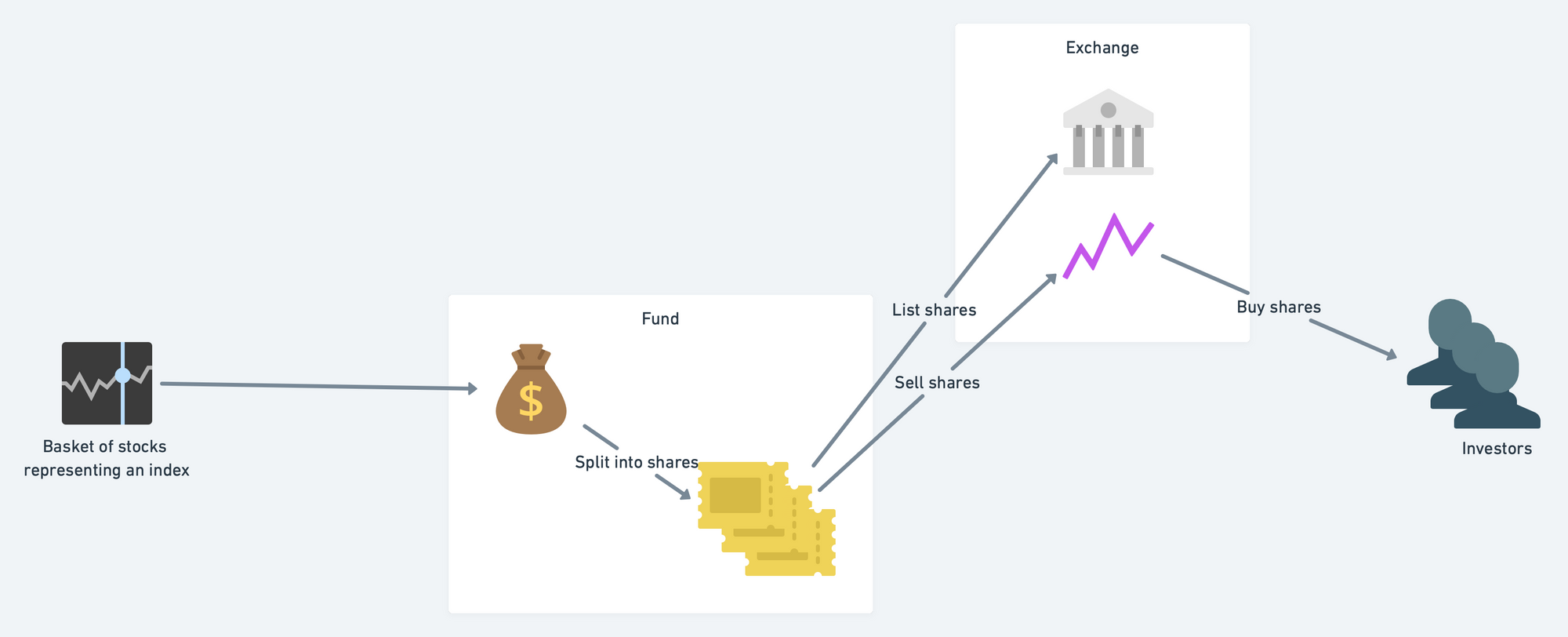

What's an ETF? It is a fund that is traded on exchanges, just like the name - Exchange Traded Fund - indicates. What's a fund? For the purpose of this article a fund is money pooled together to acquire certain assets.

In order to turn a fund into an ETF, you need to divide it into shares that comply with securities law and list these shares on an exchange so investors that are connected to this exchange can buy them.

If you make an ETF that holds all the shares that constitute the S&P500 index, you get $SPY.

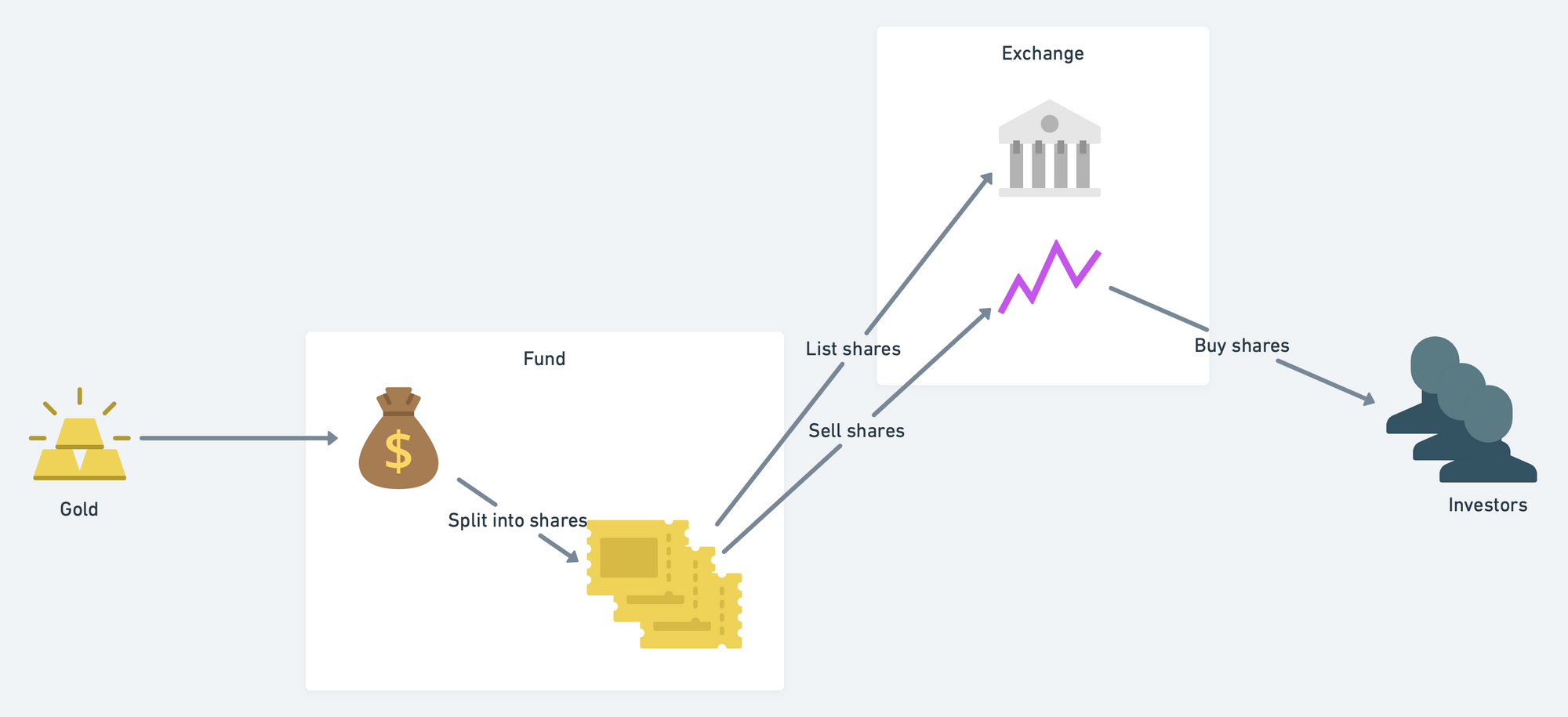

If you make an ETF that holds gold, you get $GLD.

The idea is that you can expose yourself to the upward and downward price movement of the underlying asset. If the price of gold goes up, then $GLD goes up.

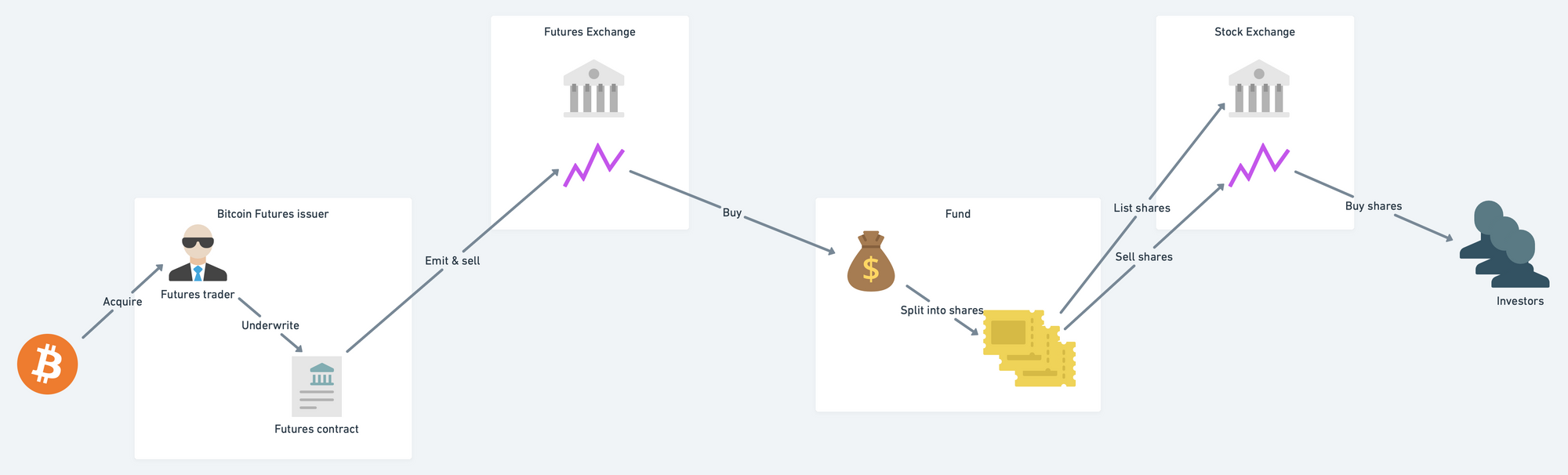

But that's not what the Bitcoin futures ETF is. The Bitcoin futures ETF is an ETF for which the asset is not Bitcoin. It is Bitcoin futures.

What are futures then? And is this technicality such a deal breaker?

Futures are not an asset, they are a contract to take delivery of a certain amount of goods at a later date. When you buy futures you pay now and you get the goods later. It's a financial instrument that has been in use since farmers needed to guarantee some form of income upfront while the clients of the farmers wanted a guaranted delivery for a price established earlier. "Now", "then", "later", "earlier". Futures are all about time. Futures contracts have an expiry date. They only exist for a few weeks or months. Once they're expired, futures are worthless.

But let's go back to our Bitcoin Futures ETF, shall we?

What does the picture look like with futures inserted?

When you buy a Bitcoin Futures ETF, you buy shares that are backed by futures. These futures contracts basically say "at such date, you will take delivery of X amount of Bitcoin".

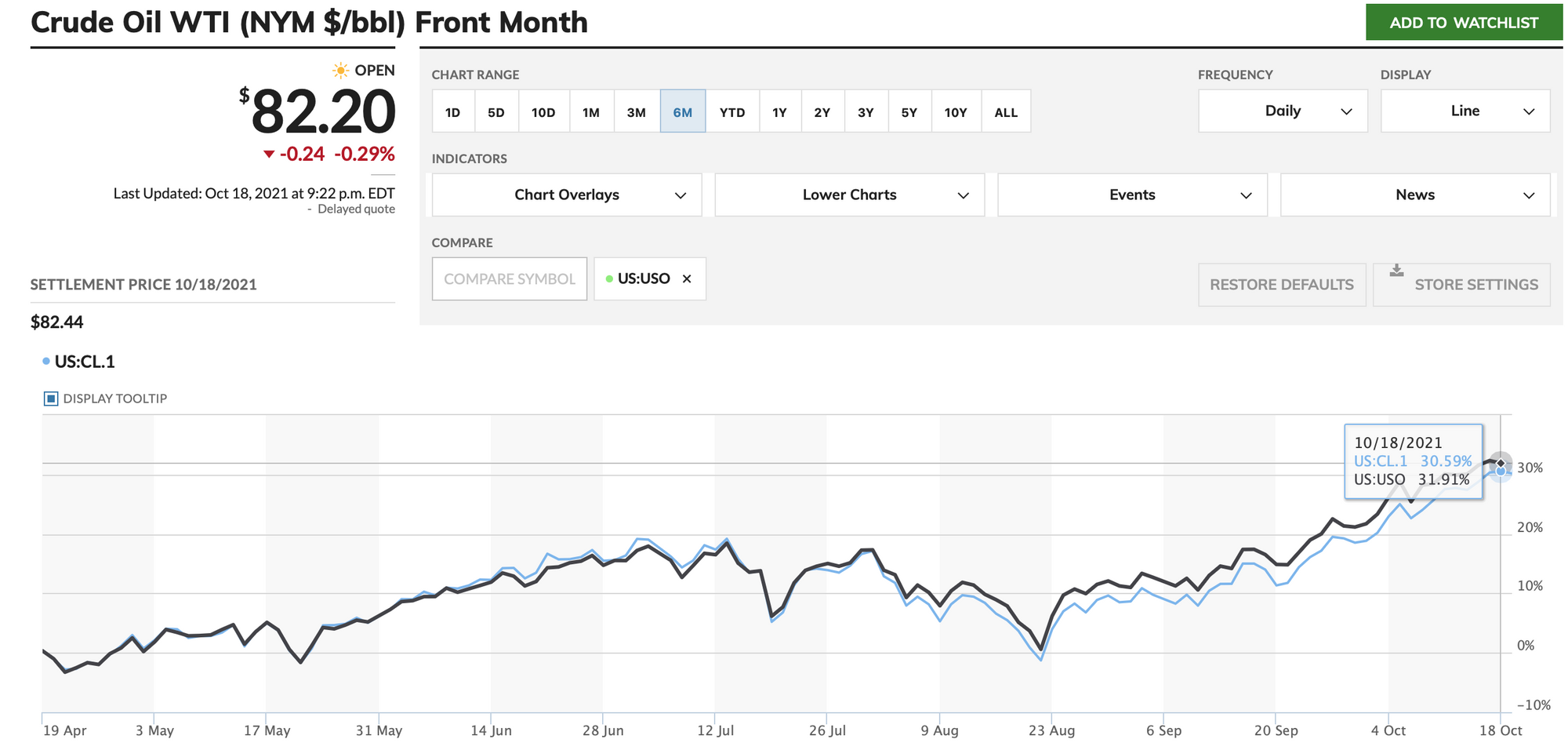

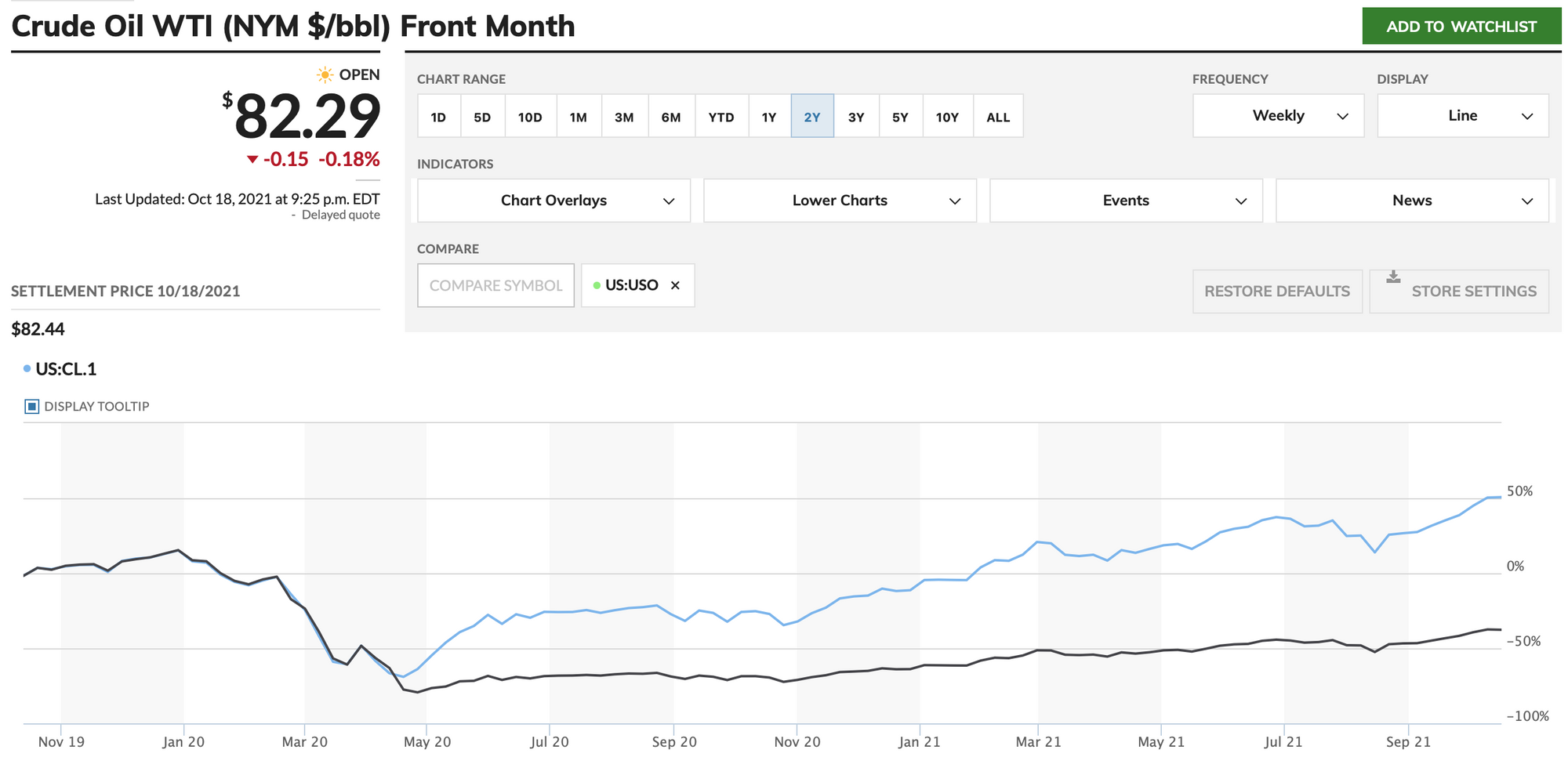

But the company that manages the Bitcoin ETF does not want to take delivery of Bitcoin. They just want futures. And besides, these contracts all have an expiry. As time passes, the fund has to keep on "rolling" their futures: buying long term contracts and selling the short term ones to maintain the desired quantity, the desired exposure. Sometimes, the long-term futures are more expensive than the short-term ones, even after adjusting for time. And sometimes it's the opposite. There is inherent risk in these trades. This risk and all of the operational cost of maintaining these futures is passed on to the ETF purchaser. This is why any ETF that is backed by futures tend to, over the long term, underperform the asset it is supposed to represent. Check out, for example $USO vs. WTI, the underlying commodity it is supposed to represent.

And sometimes an ETF simply decouples from the asset it should track:

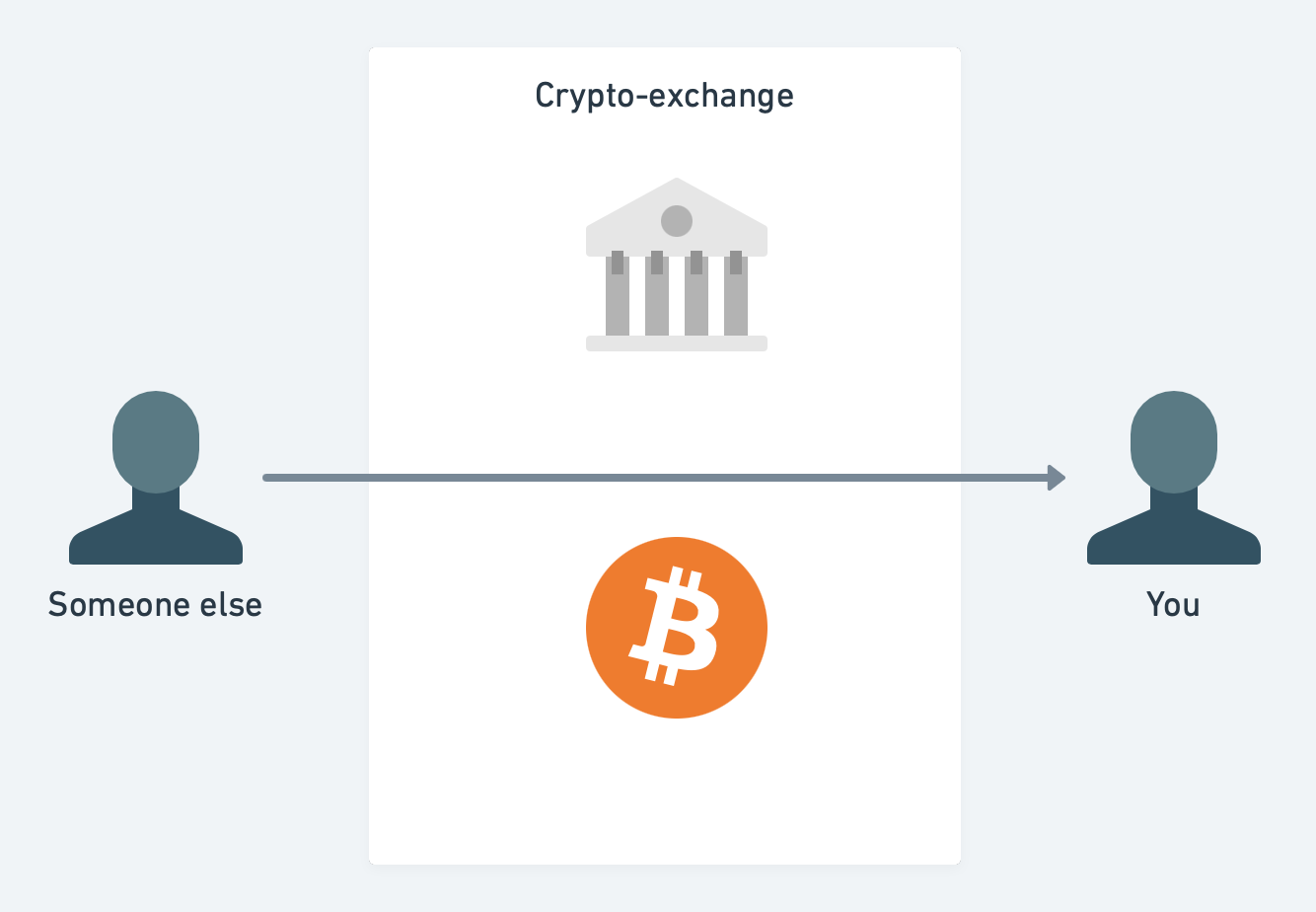

So, you see, the difference between buying BTC and buying a futures ETF is quite considerable:

- When you buy Bitcoin, you own it,

- When you buy the upcoming ETF, you'll be owning shares of a fund that owns futures for delivery of Bitcoin it does not intend on owning, and this fund will have costs that will ripple down to you.

Don't settle for a substitute. Get the real thing. It is more straightforward. And, by the way, do not be fooled by the "attractive" price point the ETF will start trading at. Remember that Bitcoin is highly divisible. Buy Bitcoin with the same amount you'd have placed in the ETF and you'll be better of.

And, finally, how can this ETF be "bad" for the subscriber of this newsletter, yet still be positive to Bitcoin in general? That's because institutions, hedge funds and many other entities can now expose themselves to Bitcoin a lot more easily. Such interest, once satisfied, will increase the market capitalization of the asset. It will strengthen the price by inviting parties that were on the sidelines, now reassured that they can get access without compromising the ease and convenience of simply adding another stock ticker to their holdings. With more people joining, Bitcoin becomes bigger, it accumulates gravitas. It takes on momentum and attracts even more interest.